How Much Money Do You Need to Retire Comfortably in 2025?

Ever wondered what that golden number is? The one that unlocks the door to leisurely mornings, travel adventures, and finally pursuing that passion project you've always dreamed of? We're talking about retirement, of course, and more specifically, how much money you'll actually need to retire comfortably in 2025.

The thought of retirement can be both exciting and daunting. On one hand, freedom! On the other, the reality of living off your savings for potentially decades can feel overwhelming. Inflation is rising, healthcare costs are unpredictable, and the idea of making your money last seems harder than ever.

While there's no one-size-fits-all answer, a commonly cited rule of thumb suggests needing around 25 times your annual expenses saved by the time you retire. So, if you anticipate needing $60,000 per year to live comfortably, you'd ideally have $1.5 million saved. However, this is just a starting point, and your individual needs and circumstances will significantly impact the final number.

In short, planning for a comfortable retirement in 2025 involves assessing your current and future expenses, estimating your investment returns, and accounting for inflation and healthcare costs. Key concepts include retirement planning, financial independence, investment strategies, and understanding the impact of inflation on your savings. Let's dive deeper into the details and explore the various factors that will help you determine your magic retirement number.

Understanding Your Current Financial Situation

This first step involves taking a long, hard look at your current financial state. It's about knowing where you stand before you can chart a course to where you want to be. It might seem a bit intimidating, but I promise it's empowering! I remember when I first sat down to seriously analyze my finances a few years ago. I had a vague idea of my income and expenses, but seeing it all laid out in black and white was eye-opening. I realized I was spending more on certain things than I thought, and I identified areas where I could easily cut back. This process alone gave me a sense of control and boosted my motivation to save for retirement. So, start by tracking your income, listing all your expenses (fixed and variable), and determining your net worth (assets minus liabilities). This detailed picture will serve as the foundation for your retirement plan. Don't forget to factor in any debts you may have, such as mortgages, student loans, or credit card balances. These debts can significantly impact your retirement savings, so it's essential to address them as early as possible. Once you have a clear understanding of your current financial situation, you can start estimating your future expenses and determining how much you'll need to retire comfortably in 2025.

Estimating Your Future Retirement Expenses

Estimating your future retirement expenses is crucial for determining how much money you'll need to retire comfortably in 2025. This involves projecting your living expenses, healthcare costs, and any other anticipated expenditures during retirement. Consider your lifestyle, travel plans, and any hobbies or activities you plan to pursue. Will you downsize your home, travel extensively, or volunteer your time? These factors will all influence your spending habits. Don't forget to account for inflation, which can erode the purchasing power of your savings over time. Also, it's important to research and understand the average cost of healthcare in retirement. Healthcare expenses can be a significant burden, so it's wise to factor them into your retirement plan. Consider long-term care insurance or other strategies to protect your savings from unexpected medical costs. A good way to estimate your future expenses is to create a detailed budget that includes all your anticipated expenditures. You can use online budgeting tools or spreadsheets to track your spending and make adjustments as needed. Remember, it's better to overestimate your expenses than underestimate them, as it's always better to have more savings than you need. Be realistic about your spending habits and consider any potential unforeseen expenses. With careful planning and estimation, you can develop a clear picture of your future retirement expenses and determine how much money you'll need to retire comfortably in

2025.

The History and Myths of Retirement Savings

The concept of retirement, as we know it today, is a relatively modern invention. Historically, people worked until they were physically unable to do so, often relying on family for support in their later years. The rise of industrialization and social security systems in the 20th century led to the establishment of formal retirement plans. One common myth is that Social Security will cover all your retirement expenses. While Social Security can provide a valuable source of income, it's unlikely to be sufficient to maintain your current lifestyle. Many people also believe that they can catch up on retirement savings later in life. While it's never too late to start saving, it's much easier to accumulate wealth when you start early and take advantage of the power of compounding. Another myth is that you need a huge lump sum to retire comfortably. While having a large nest egg is certainly helpful, it's also important to consider other sources of income, such as pensions, annuities, and part-time work. The key is to create a diversified portfolio that provides a steady stream of income throughout your retirement years. It's essential to dispel these myths and focus on creating a realistic and achievable retirement plan. By understanding the history of retirement and debunking common misconceptions, you can make informed decisions about your financial future and ensure a comfortable retirement in 2025.

Unveiling the Hidden Secrets of Retirement Planning

One often overlooked aspect of retirement planning is the impact of taxes. Taxes can significantly reduce your retirement savings, so it's essential to understand the tax implications of your investment accounts and withdrawal strategies. Consider consulting with a tax advisor to develop a tax-efficient retirement plan. Another secret is the importance of diversification. Diversifying your investment portfolio across different asset classes, such as stocks, bonds, and real estate, can help reduce risk and increase returns. Don't put all your eggs in one basket. It's also crucial to regularly review and adjust your retirement plan as your circumstances change. Life events such as marriage, divorce, or job loss can significantly impact your retirement savings, so it's essential to stay flexible and adapt to changing circumstances. Furthermore, don't underestimate the power of lifestyle changes. Making small adjustments to your spending habits can have a big impact on your retirement savings over time. Consider cutting back on unnecessary expenses and prioritizing experiences over material possessions. Finally, remember that retirement is not just about money. It's also about finding purpose and fulfillment in your life. Plan for activities, hobbies, and social connections that will keep you engaged and active during your retirement years. By unveiling these hidden secrets of retirement planning, you can maximize your savings and ensure a fulfilling and comfortable retirement in 2025.

Our Recommendation for a Comfortable Retirement

Our top recommendation for achieving a comfortable retirement in 2025 is to start planning early and consistently save as much as you can afford. The power of compounding is a significant advantage, and the earlier you start saving, the more time your money has to grow. Consider automating your savings by setting up automatic transfers from your checking account to your retirement accounts. This will make saving effortless and ensure that you consistently contribute to your retirement goals. We also recommend diversifying your investment portfolio to reduce risk and maximize returns. Allocate your assets across different asset classes based on your risk tolerance and time horizon. Consult with a financial advisor to develop a personalized investment strategy that meets your individual needs. Furthermore, don't be afraid to seek professional financial advice. A qualified financial advisor can provide valuable guidance on retirement planning, investment management, and tax strategies. They can help you create a comprehensive retirement plan that takes into account your individual circumstances and goals. Finally, stay informed about the latest retirement planning trends and regulations. The rules and regulations surrounding retirement savings can change over time, so it's essential to stay up-to-date on the latest developments. By following these recommendations, you can increase your chances of achieving a comfortable and fulfilling retirement in 2025.

The Role of Inflation in Retirement Planning

Inflation is a critical factor to consider in retirement planning. It refers to the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. This means that the same amount of money will buy you less in the future than it does today. When planning for retirement, you need to account for inflation to ensure that your savings will be sufficient to cover your expenses throughout your retirement years. There are several ways to factor inflation into your retirement plan. One approach is to use an inflation-adjusted return when estimating your investment growth. This means subtracting the expected inflation rate from your expected investment return. For example, if you expect your investments to grow at 7% per year and inflation is expected to be 3% per year, you would use an inflation-adjusted return of 4%. Another approach is to explicitly estimate your future expenses in today's dollars and then inflate those expenses to account for future inflation. You can use online inflation calculators to estimate the future cost of goods and services. It's also important to remember that inflation can vary depending on the specific goods and services you consume. For example, healthcare costs tend to rise faster than overall inflation, so it's essential to factor this into your retirement plan. By carefully considering the role of inflation in retirement planning, you can ensure that your savings will be sufficient to maintain your desired lifestyle throughout your retirement years.

Top Tips for Maximizing Your Retirement Savings

Maximizing your retirement savings requires a strategic approach and consistent effort. One of the most effective tips is to take advantage of employer-sponsored retirement plans, such as 401(k)s. Many employers offer matching contributions, which is essentially free money. Be sure to contribute enough to your 401(k) to receive the full employer match. Another important tip is to increase your savings rate over time. As your income increases, gradually increase the amount you contribute to your retirement accounts. Even small increases can make a big difference over the long term. Consider setting up automatic escalations to your savings rate each year. You can also explore other tax-advantaged retirement accounts, such as Roth IRAs and traditional IRAs. These accounts offer different tax benefits, so it's important to choose the one that best suits your individual circumstances. Another tip is to avoid taking early withdrawals from your retirement accounts. Early withdrawals can result in penalties and taxes, and they can significantly reduce your retirement savings. If possible, try to avoid tapping into your retirement funds until you actually retire. Finally, review your retirement plan regularly and make adjustments as needed. Your circumstances may change over time, so it's important to ensure that your retirement plan remains aligned with your goals. By following these tips, you can maximize your retirement savings and increase your chances of achieving a comfortable retirement in 2025.

Understanding the 4% Rule

The 4% rule is a guideline often used in retirement planning to determine how much money you can withdraw from your retirement accounts each year without running out of money. The rule states that you can withdraw 4% of your initial retirement savings in the first year of retirement, and then adjust that amount each year for inflation. For example, if you retire with $1 million in savings, you can withdraw $40,000 in the first year, and then increase that amount each year to keep pace with inflation. The 4% rule is based on historical data and simulations, and it is designed to provide a high probability of success over a 30-year retirement period. However, it's important to understand that the 4% rule is not a guarantee, and there are several factors that can affect its success. One factor is the performance of your investments. If your investments perform poorly, you may need to reduce your withdrawals to avoid running out of money. Another factor is inflation. If inflation is higher than expected, you may need to withdraw more money to maintain your standard of living, which could increase the risk of running out of money. It's also important to consider your individual circumstances when applying the 4% rule. For example, if you plan to retire for longer than 30 years, or if you have significant healthcare expenses, you may need to withdraw less than 4% per year. Despite its limitations, the 4% rule can be a useful starting point for retirement planning. It provides a simple and easy-to-understand guideline for determining how much money you can withdraw from your retirement accounts each year. However, it's important to consult with a financial advisor to develop a personalized retirement plan that takes into account your individual circumstances and goals.

Fun Facts About Retirement

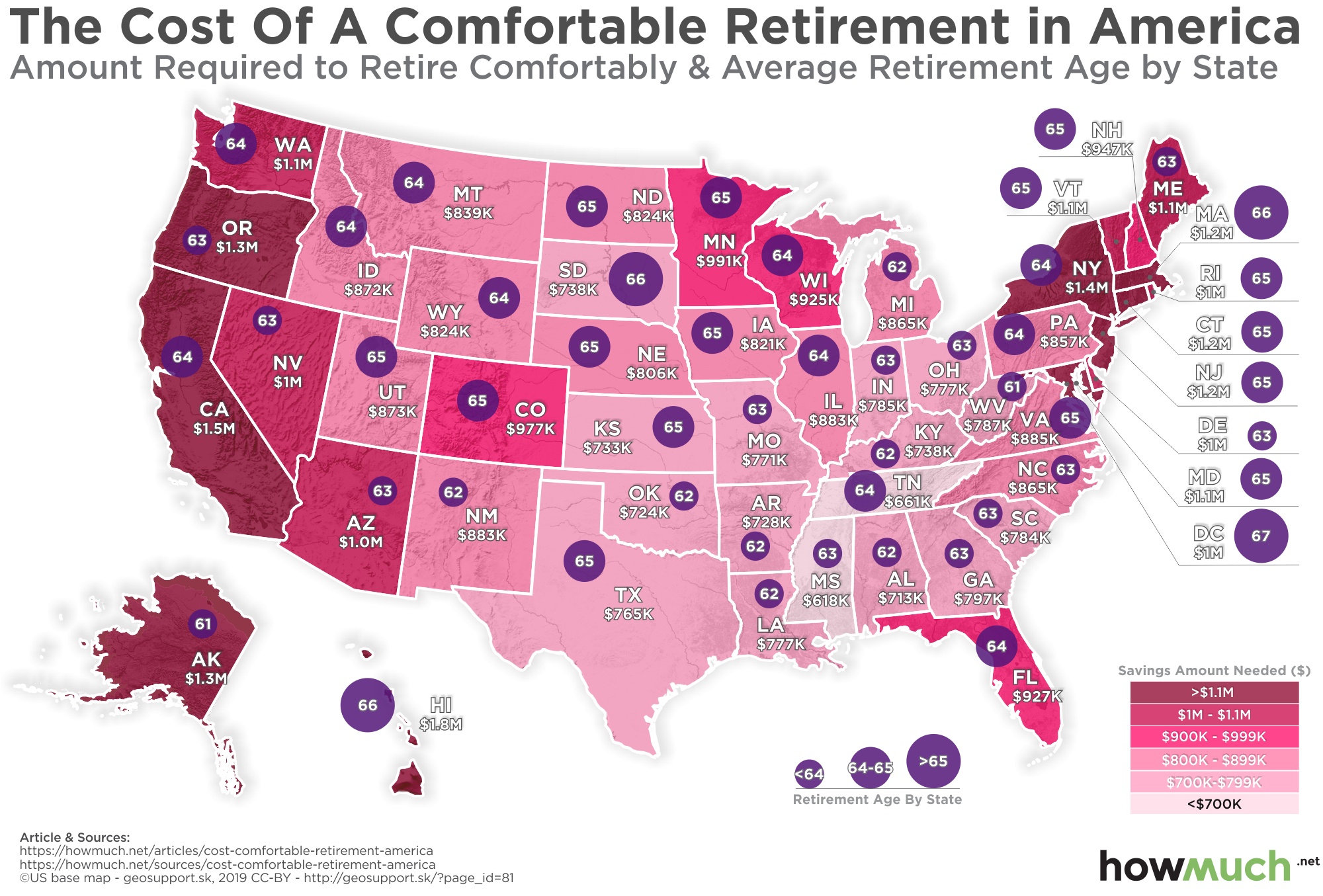

Did you know that the average retirement age in the United States is around 63 years old? However, this can vary depending on factors such as occupation, health, and financial situation. Another fun fact is that many retirees choose to relocate to warmer climates or smaller towns. Some popular retirement destinations include Florida, Arizona, and North Carolina. Retirement can also be a time for pursuing new hobbies and interests. Many retirees take up activities such as gardening, traveling, or volunteering. It's also a great time to spend more time with family and friends. Studies have shown that retirees who stay active and engaged tend to be happier and healthier. Retirement is not just about relaxing and doing nothing. It's about finding new ways to stay active, connected, and fulfilled. It's also important to remember that retirement is a long-term journey. It's not a one-time event, but rather a transition to a new phase of life. It's essential to plan for the long term and make sure that you have enough savings to cover your expenses throughout your retirement years. Retirement can be a wonderful time of life, full of opportunities for new experiences and personal growth. By planning ahead and making smart financial decisions, you can ensure that you have a comfortable and fulfilling retirement in 2025.

How To Build a Retirement Nest Egg

Building a substantial retirement nest egg requires a combination of saving, investing, and planning. The first step is to create a budget and track your expenses. This will help you identify areas where you can cut back and save more money. Once you have a budget in place, you can start setting savings goals. Aim to save at least 15% of your income for retirement. If you can save more, even better! Next, you need to choose the right investment vehicles. Consider investing in a mix of stocks, bonds, and other assets to diversify your portfolio. You can invest through employer-sponsored retirement plans, such as 401(k)s, or through individual retirement accounts (IRAs). It's also important to rebalance your portfolio periodically to ensure that it remains aligned with your risk tolerance and time horizon. Rebalancing involves selling some assets and buying others to maintain your desired asset allocation. Another key element of building a retirement nest egg is to stay disciplined and avoid making emotional investment decisions. Market fluctuations are normal, and it's important to stay calm and stick to your long-term investment plan. Don't try to time the market or make impulsive decisions based on short-term market trends. Finally, seek professional financial advice if needed. A qualified financial advisor can help you create a personalized retirement plan and make informed investment decisions. By following these steps, you can build a substantial retirement nest egg and ensure a comfortable retirement in 2025.

What If You Haven't Saved Enough for Retirement?

It's a common concern, but don't panic! There are still steps you can take to improve your situation. First, assess your current financial state realistically. How much have you saved? What are your current expenses? How long do you plan to work? Once you have a clear picture of your situation, you can start developing a plan to catch up. One option is to increase your savings rate. Even small increases can make a big difference over time. Consider cutting back on discretionary expenses and redirecting those funds to your retirement accounts. Another option is to work longer. Delaying retirement by a few years can significantly increase your retirement savings and reduce the number of years you need to live off your savings. You can also consider downsizing your home or relocating to a lower-cost area. This can free up cash and reduce your ongoing expenses. Another strategy is to explore alternative income sources during retirement. Consider part-time work, consulting, or starting a small business. These activities can provide additional income and help you supplement your retirement savings. Finally, seek professional financial advice. A qualified financial advisor can help you develop a plan to catch up on your retirement savings and make informed financial decisions. By taking these steps, you can improve your chances of achieving a comfortable retirement, even if you haven't saved as much as you would like.

Top 5 Actionable Steps To Retirement Comfortably in 2025

Let's boil it down to actionable steps for a more comfortable retirement in 2025:

1.Calculate Your Number: Use online calculators or consult a financial advisor to determine your personalized retirement savings goal.

2.Maximize Savings: Increase your contributions to retirement accounts, taking advantage of employer matches and tax benefits.

3.Diversify Investments: Allocate your assets across different asset classes to reduce risk and increase potential returns.

4.Plan for Healthcare: Estimate your future healthcare costs and consider long-term care insurance or other strategies to protect your savings.

5.Seek Professional Advice: Consult with a financial advisor to develop a comprehensive retirement plan that meets your individual needs and goals.

Each of these steps plays a crucial role in ensuring a comfortable and secure retirement. Calculating your number provides a target to aim for, while maximizing savings helps you reach that target faster. Diversifying investments reduces risk and increases potential returns, while planning for healthcare protects your savings from unexpected medical costs. Finally, seeking professional advice provides valuable guidance and support throughout the retirement planning process. By following these actionable steps, you can take control of your financial future and increase your chances of achieving a comfortable retirement in 2025. It's a journey, not a sprint, and every little bit counts! Remember to stay focused, stay informed, and stay proactive.

Question and Answer About Retirement Comfortably in 2025

Q: How does inflation impact my retirement savings?

A: Inflation erodes the purchasing power of your savings over time. You need to factor inflation into your retirement plan to ensure that your savings will be sufficient to cover your expenses throughout your retirement years.

Q: What is the 4% rule, and how does it work?

A: The 4% rule is a guideline that suggests you can withdraw 4% of your initial retirement savings in the first year of retirement and then adjust that amount each year for inflation. It's a useful starting point, but it's important to consider your individual circumstances and consult with a financial advisor.

Q: What if I haven't saved enough for retirement?

A: Don't panic! There are still steps you can take to improve your situation. Increase your savings rate, work longer, downsize your home, explore alternative income sources, and seek professional financial advice.

Q: How can I maximize my retirement savings?

A: Take advantage of employer-sponsored retirement plans, increase your savings rate over time, explore tax-advantaged retirement accounts, avoid taking early withdrawals, and review your retirement plan regularly.

Conclusion of How Much Money Do You Need to Retire Comfortably in 2025?

Ultimately, figuring out how much money you need to retire comfortably in 2025 is a deeply personal journey. It requires honest self-assessment, careful planning, and a willingness to adapt to changing circumstances. By understanding your current financial situation, estimating your future expenses, and taking proactive steps to maximize your savings, you can create a roadmap to financial independence and a fulfilling retirement. Remember, it's never too late to start planning, and even small steps can make a big difference over time. So, take control of your financial future and start building the retirement you've always dreamed of!

Post a Comment