15 Retirement Planning Mistakes That Cost You Thousands

Imagine looking forward to retirement, picturing those golden years of relaxation and travel, only to realize you've made some missteps that significantly impact your financial security. It's a scenario nobody wants to face, but it's more common than you might think.

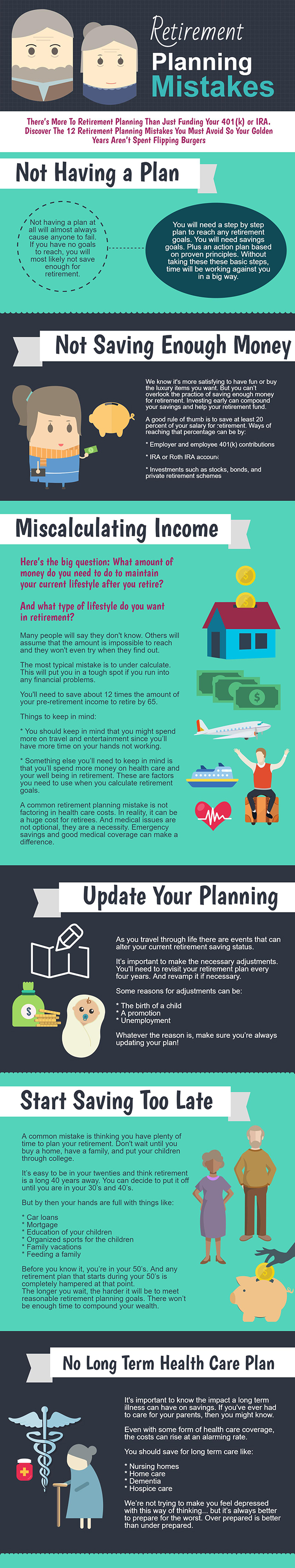

Many people dream of a comfortable retirement, but the path to achieving that dream is often riddled with unforeseen challenges. From not saving enough early on to making poor investment choices or underestimating healthcare costs, the obstacles can seem insurmountable. The worry about outliving savings, dealing with unexpected expenses, and potentially having to drastically alter retirement plans can be incredibly stressful.

This blog post aims to shed light on 15 common retirement planning mistakes that can cost you thousands of dollars. By understanding these pitfalls, you can take proactive steps to avoid them and secure a more financially stable future. We'll delve into areas like neglecting inflation, failing to diversify investments, drawing down accounts too early, and much more, equipping you with the knowledge to make informed decisions and protect your retirement nest egg.

In this article, we've uncovered 15 critical retirement planning mistakes that could severely impact your financial future. We've addressed the importance of starting early, the dangers of ignoring inflation, the significance of investment diversification, and the perils of withdrawing funds prematurely. Moreover, we touched upon the crucial aspects of estimating healthcare expenses, understanding tax implications, and creating a robust retirement budget. By being mindful of these areas and taking corrective action, you can steer clear of costly errors and pave the way for a more secure and fulfilling retirement. Key phrases discussed include: retirement planning, retirement savings, investment strategy, financial security, retirement budget, healthcare costs, tax planning.

Not Starting Early Enough

My neighbor, Sarah, always talked about how she was going to start saving for retirement "next year." Year after year, "next year" never seemed to arrive. She prioritized immediate expenses and indulgences, thinking she had plenty of time to catch up later. When she finally did start, she was shocked at how much she needed to save each month to reach her goals, a far larger sum than if she'd started even a few years earlier. She had missed out on crucial years of compounding interest, a powerful force that could have significantly boosted her retirement savings.

This highlights a crucial retirement planning mistake: procrastination. The earlier you begin saving, the more time your money has to grow. Compound interest, often referred to as the "eighth wonder of the world," works by generating earnings on your initial investment and then earning further returns on those accumulated earnings. Delaying your start means missing out on this exponential growth. Even small contributions made early on can make a substantial difference over the long term. Use retirement calculators to understand your current trajectory and identify actions you need to take to stay on track.

Failing to Diversify Investments

Imagine putting all your eggs in one basket, then tripping and dropping the basket. That's essentially what happens when you don't diversify your investments. Diversification means spreading your investments across different asset classes, such as stocks, bonds, and real estate. The goal is to reduce risk by ensuring that if one investment performs poorly, others may perform well, offsetting the losses.

Without diversification, your retirement savings are overly exposed to the volatility of a single investment or sector. For example, if you invested solely in technology stocks during the dot-com bubble, you likely experienced significant losses when the bubble burst. A well-diversified portfolio, on the other hand, can weather market fluctuations more effectively, protecting your retirement savings from catastrophic losses. Consider working with a financial advisor to create a diversified investment strategy tailored to your risk tolerance and retirement goals.

Ignoring Inflation

Many people underestimate the impact of inflation on their retirement savings. Inflation is the rate at which the general level of prices for goods and services is rising, and purchasing power is falling. What costs $1 today might cost considerably more in 20 or 30 years, and that means you'll need more money in retirement to maintain your current lifestyle.

People often base their retirement income needs on their current expenses, failing to account for the fact that those expenses will likely increase over time due to inflation. This can lead to a significant shortfall in retirement savings. To combat this, it's essential to factor inflation into your retirement projections. Use realistic inflation rates (historical averages are a good starting point) and adjust your savings goals accordingly. Consider investing in assets that tend to outpace inflation, such as stocks and real estate.

Withdrawing Too Much Too Soon

The lure of a lump sum can be tempting, but withdrawing too much money from your retirement accounts early in retirement can be a major mistake. This can significantly deplete your savings, leaving you vulnerable to outliving your money.

Many retirees underestimate their life expectancy and overestimate the amount of money they can safely withdraw each year. A common rule of thumb is the "4% rule," which suggests withdrawing 4% of your retirement savings in the first year and then adjusting that amount for inflation in subsequent years. However, this rule is not foolproof and may not be suitable for everyone. Consider consulting with a financial advisor to determine a sustainable withdrawal rate based on your individual circumstances, life expectancy, and investment portfolio.

Underestimating Healthcare Costs

One of the biggest expenses in retirement is healthcare. Many people underestimate just how much healthcare will cost, leading to significant financial strain later on.

Healthcare costs tend to rise faster than inflation, and unexpected medical expenses can quickly deplete your savings. In addition to health insurance premiums, consider the costs of deductibles, copays, prescription drugs, and long-term care. Explore options like Medicare supplemental insurance (Medigap) and long-term care insurance to help protect yourself from these expenses. Factor healthcare costs into your retirement budget and plan accordingly.

Other Retirement Planning Mistakes

Other common retirement planning mistakes include failing to create a budget, not understanding tax implications, neglecting estate planning, not adjusting your plan as circumstances change, and relying solely on Social Security. Each of these can have a significant impact on your financial security in retirement.

Failing to Create a Retirement Budget

Without a budget, you're essentially flying blind when it comes to retirement finances. A budget helps you understand your income, expenses, and savings needs, allowing you to make informed decisions about how to allocate your resources.

Many people enter retirement without a clear understanding of their spending habits. They may underestimate their expenses or fail to account for unexpected costs. A retirement budget should include all sources of income, such as Social Security, pensions, and investment withdrawals, as well as all expenses, including housing, food, transportation, healthcare, and entertainment. Regularly review and adjust your budget to ensure it aligns with your financial goals and changing circumstances.

Not Understanding Tax Implications

Taxes can have a significant impact on your retirement savings. Understanding the tax implications of different retirement accounts and investment strategies is crucial for maximizing your after-tax income.

Different retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, have different tax implications. Some offer tax-deferred growth, while others offer tax-free withdrawals in retirement. It's important to understand the advantages and disadvantages of each type of account and choose the ones that best suit your individual needs. Additionally, be aware of the tax implications of withdrawing funds from your retirement accounts, as these withdrawals are often taxed as ordinary income. Consult with a tax advisor to develop a tax-efficient retirement plan.

Fun Facts About Retirement Planning

Did you know that the average retirement lasts for about 18 years? Or that Social Security was originally intended to supplement, not replace, retirement savings? These fun facts highlight the importance of planning for a long and financially secure retirement.

Many people underestimate the length of their retirement and overestimate the amount of income they will receive from Social Security. This can lead to a significant shortfall in retirement savings. It's important to plan for a long retirement and to have a diversified income stream that includes Social Security, pensions, and investment withdrawals. Additionally, be aware of the potential for changes to Social Security benefits in the future.

How to Correct Retirement Planning Mistakes

The good news is that it's never too late to correct retirement planning mistakes. Even if you've made some of the errors discussed in this blog post, there are steps you can take to get back on track.

The first step is to assess your current financial situation. This includes evaluating your savings, investments, debt, and expenses. Once you have a clear understanding of your financial standing, you can begin to develop a plan to address any shortcomings. This may involve increasing your savings rate, adjusting your investment strategy, paying down debt, or reducing your expenses. Consider working with a financial advisor to create a personalized plan that meets your individual needs and goals.

What If You Make These Mistakes?

Making retirement planning mistakes can have serious consequences, potentially jeopardizing your financial security and forcing you to make difficult choices in retirement.

If you realize you've made some of the mistakes discussed in this blog post, don't panic. The most important thing is to take action and address the issues as soon as possible. This may involve working longer, delaying retirement, reducing your expenses, or seeking financial assistance. It's also important to learn from your mistakes and to make a plan to avoid repeating them in the future. Remember, it's never too late to improve your financial situation and secure a more comfortable retirement.

List of 15 Retirement Planning Mistakes

Here's a consolidated list of the 15 retirement planning mistakes we've discussed: 1. Not starting early enough,

2. Failing to diversify investments,

3. Ignoring inflation,

4. Withdrawing too much too soon,

5. Underestimating healthcare costs,

6. Failing to create a budget,

7. Not understanding tax implications,

8. Neglecting estate planning,

9. Relying solely on Social Security,

10. Not adjusting your plan as circumstances change,

11. Overestimating investment returns,

12. Taking on too much debt,

13. Failing to account for long-term care,

14. Not seeking professional advice,

15. Ignoring emotional biases.

Avoiding these mistakes can significantly improve your chances of a comfortable and secure retirement. Remember, retirement planning is a marathon, not a sprint. It requires careful planning, discipline, and a willingness to adapt to changing circumstances.

Question and Answer

Q: How much should I be saving for retirement?

A: A general rule of thumb is to save at least 15% of your income for retirement, including any employer contributions. However, the exact amount you need to save will depend on your individual circumstances, such as your age, income, expenses, and retirement goals.

Q: What is the best investment strategy for retirement?

A: The best investment strategy for retirement depends on your risk tolerance, time horizon, and financial goals. A diversified portfolio that includes stocks, bonds, and real estate is generally recommended. Consider consulting with a financial advisor to create a personalized investment strategy.

Q: How can I reduce my healthcare costs in retirement?

A: There are several ways to reduce your healthcare costs in retirement, such as choosing a Medicare plan that meets your needs, taking advantage of preventive care services, and maintaining a healthy lifestyle. You can also consider purchasing long-term care insurance to protect yourself from the costs of long-term care.

Q: What should I do if I'm behind on my retirement savings?

A: If you're behind on your retirement savings, don't panic. There are several steps you can take to catch up, such as increasing your savings rate, delaying retirement, reducing your expenses, and working with a financial advisor.

Conclusion of 15 Retirement Planning Mistakes

Planning for retirement can feel overwhelming, but by understanding these common pitfalls and taking proactive steps to avoid them, you can significantly increase your chances of a secure and fulfilling retirement. Remember to start early, diversify your investments, account for inflation, create a budget, and seek professional advice when needed. Your future self will thank you!

Post a Comment