Free Retirement Budget Worksheet: Plan Your Retirement Expenses

Retirement. That golden word conjures up images of relaxation, travel, and pursuing long-held passions. But before you can kick back and enjoy those sunset years, there's a crucial step: planning. And a big part of that planning involves understanding your future expenses.

Many people find themselves staring blankly at spreadsheets, unsure where to even begin estimating what their life will cost once they stop working. They worry about unexpected healthcare costs, inflation eroding their savings, and simply not knowing if they'll have enough to live comfortably.

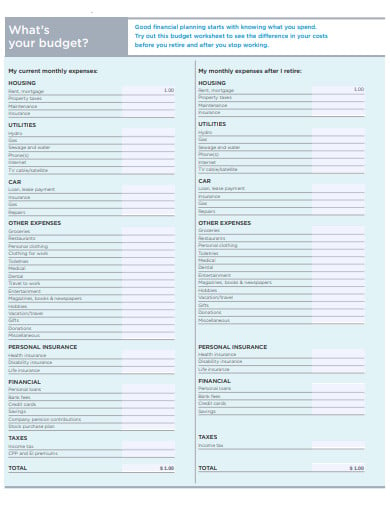

That's where a free retirement budget worksheet comes in handy! It's designed to help you project your future expenses, giving you a clearer picture of your financial needs in retirement and empowering you to take control of your financial future.

This article explores the benefits of using a retirement budget worksheet, highlighting how it helps you anticipate expenses, track your savings progress, and make informed decisions about your retirement planning. A retirement budget worksheet is a tool designed to help you estimate and plan your expenses during retirement. We'll look at its components, benefits, and ways to use it effectively to achieve a financially secure retirement.

The Importance of Planning Retirement Expenses

My own wake-up call came when my parents started talking about retirement. They had always been diligent savers, but when I asked about their budget, their answer was a vague "We'll figure it out." Figuring it out later is not the best method. That simple phrase sent a chill down my spine. It made me realize that even people who seem well-prepared can underestimate the complexities of retirement planning. It prompted me to learn about the importance of projecting your future expenses to better prepare and protect your retirement future.

Retirement isn't just about having a lump sum of savings; it's about understanding how those savings will sustain you over potentially several decades. Unexpected expenses can derail even the best-laid plans. Proper planning means identifying potential costs like healthcare, travel, hobbies, and even increased utility bills if you plan to spend more time at home. A retirement budget worksheet acts as a roadmap, guiding you through these considerations and helping you create a realistic financial picture.

By thoughtfully estimating your expenses, you can also determine if your current savings rate is sufficient. Maybe you need to increase your contributions to your 401k or IRA. Maybe you need to explore alternative investment strategies. Or, perhaps, the worksheet will reveal that you're already on track, providing valuable peace of mind. Whatever the outcome, using a retirement budget worksheet is an empowering step toward securing your financial future and ensuring you can enjoy your retirement years without financial stress. It allows you to make adjustments now to avoid future financial strain.

What is a Retirement Budget Worksheet?

A retirement budget worksheet is essentially a structured tool designed to help you estimate your income and expenses during retirement. It's more than just a simple list; it's a comprehensive framework that prompts you to consider various aspects of your future finances. It forces you to think about your current spending habits and how those might change as you transition into retirement.

These worksheets typically include sections for estimating income sources such as Social Security, pensions, 401k withdrawals, and other investments. Then, they guide you through a detailed breakdown of potential expenses, categorized into areas like housing, healthcare, food, transportation, entertainment, and travel. A good worksheet will also include a section for unexpected or irregular expenses, such as home repairs or medical emergencies.

Many worksheets are available in spreadsheet format (like Excel or Google Sheets), allowing for easy calculations and modifications. Some are even interactive online tools that automatically generate charts and graphs to visualize your projected income and expenses. The goal is to provide a clear, comprehensive overview of your retirement finances, enabling you to make informed decisions about your savings, spending, and investment strategies. It empowers you to take a proactive role in shaping your financial future rather than passively hoping for the best. This enables you to clearly see where you may need to cut costs or to save more to ensure a comfortable retirement.

The History and Myths of Retirement Budgeting

The idea of formal retirement planning is relatively recent, emerging primarily in the 20th century as life expectancies increased and pension systems developed. Before then, many people worked until they were physically unable, relying on family for support in their later years. The rise of Social Security and employer-sponsored retirement plans made it possible for more people to envision a distinct "retirement" phase of life.

One common myth is that retirement budgeting is only for the wealthy. This is absolutely false. Regardless of your income level, understanding your future expenses is crucial for ensuring financial security. Another myth is that you can accurately predict all your expenses decades in advance. While precision is impossible, the goal is to create a reasonable estimate based on your current lifestyle, anticipated changes, and potential unforeseen events.

Furthermore, some believe that once you create a retirement budget, you're locked into it. In reality, your budget should be a living document, regularly reviewed and adjusted to reflect changes in your circumstances, such as shifts in the economy, unexpected health issues, or alterations to your lifestyle. Using a retirement budget worksheet isn't about predicting the future perfectly; it's about developing a proactive approach to managing your finances and making informed decisions throughout your retirement journey. Staying flexible and adaptable is crucial to maintaining financial stability throughout your golden years.

The Hidden Secret of a Retirement Budget Worksheet

The hidden secret of a retirement budget worksheet isn't just about the numbers; it's about the conversations it sparks. It's a powerful tool for opening honest and important discussions with your spouse, partner, or family about your future expectations and priorities.

Going through the process of estimating expenses forces you to confront questions like: Where do we want to live? How often do we want to travel? What are our healthcare expectations? What kind of legacy do we want to leave? These conversations can reveal differing perspectives and expectations, allowing you to align your financial goals and create a shared vision for your retirement.

Moreover, the worksheet can also serve as a catalyst for exploring your values and priorities. Do you value experiences over material possessions? Are you passionate about charitable giving? Understanding your values can help you prioritize your spending and ensure that your retirement budget reflects what truly matters to you. Ultimately, the true power of a retirement budget worksheet lies in its ability to facilitate open communication, clarify your values, and create a financial plan that aligns with your dreams and aspirations for your retirement years. It's about crafting a life that's both financially secure and personally fulfilling.

Recommendation of a Retirement Budget Worksheet

There are numerous retirement budget worksheets available online, ranging from simple templates to more comprehensive interactive tools. My recommendation is to start with a basic worksheet that covers the key categories of income and expenses. This will give you a solid foundation to build upon. As you become more comfortable with the process, you can explore more advanced worksheets that incorporate features like inflation adjustments, tax projections, and scenario planning.

One popular option is the AARP Retirement Calculator, which offers a user-friendly interface and comprehensive analysis. Another is the Fidelity Retirement Income Planner, which allows you to model different withdrawal strategies and assess the sustainability of your retirement income. Many financial institutions also offer free retirement planning tools and resources to their clients. Don't be afraid to experiment with different worksheets to find one that best suits your needs and preferences.

Ultimately, the best retirement budget worksheet is the one that you actually use consistently. Choose a tool that is easy to understand, regularly updated, and aligns with your financial goals. Remember, the goal is to gain clarity and control over your retirement finances, not to get bogged down in complex calculations. The key is to start somewhere, and to regularly review and adjust your budget as your circumstances evolve. Regular review and adaptation are essential for ensuring that your plan remains relevant and effective.

Diving Deeper into Expense Categories

When creating your retirement budget, it's important to break down your expenses into specific categories to ensure a comprehensive and accurate estimate. Housing costs should include mortgage payments or rent, property taxes, insurance, and maintenance. Healthcare expenses can be particularly challenging to predict, so it's wise to overestimate potential costs, including premiums, deductibles, and out-of-pocket expenses. Food expenses should account for both groceries and dining out, while transportation costs should include car payments, insurance, gas, and public transportation.

Don't forget to factor in entertainment and recreation expenses, such as hobbies, travel, and social activities. Consider any recurring subscriptions or memberships you may have, as well as potential expenses for gifts and charitable donations. It's also crucial to include a contingency fund for unexpected expenses, such as home repairs, medical emergencies, or car repairs. A good rule of thumb is to set aside at least 5-10% of your total budget for unforeseen circumstances. Finally, remember to factor in inflation when estimating your future expenses. Inflation can significantly erode your purchasing power over time, so it's important to adjust your budget accordingly.

By carefully considering each of these expense categories, you can create a realistic and comprehensive retirement budget that reflects your individual needs and circumstances. Thoroughness and accuracy are key to developing a plan that will provide you with financial security and peace of mind throughout your retirement years. The more detail you can include, the better equipped you'll be to handle unexpected costs and adjustments to your lifestyle. Take the time to assess your current spending habits and anticipate how those habits might change in retirement.

Tips for Using a Retirement Budget Worksheet

Using a retirement budget worksheet effectively requires a thoughtful and organized approach. First, gather all the necessary financial information, including your current income, savings, investment statements, and expense records. Be realistic and honest about your spending habits. Don't underestimate your expenses or overestimate your income. Accuracy is crucial for creating a reliable budget.

Second, consider your retirement goals and lifestyle. Do you plan to travel extensively, pursue new hobbies, or downsize your home? Your retirement lifestyle will significantly impact your expenses. Research average costs for healthcare, housing, and other expenses in your desired retirement location. Use online calculators and tools to estimate your Social Security benefits and potential pension income. Be sure to factor in taxes when estimating your retirement income and expenses. Taxes can have a significant impact on your net income, so it's important to account for them in your budget.

Finally, regularly review and update your budget. Retirement planning is an ongoing process, and your budget should be adjusted as your circumstances change. Monitor your actual expenses and compare them to your budget. Identify areas where you can cut costs or increase your savings. Seek professional advice from a financial advisor if needed. A financial advisor can provide personalized guidance and help you create a comprehensive retirement plan. By following these tips, you can effectively use a retirement budget worksheet to achieve your financial goals and enjoy a comfortable retirement.

Understanding Inflation's Impact

Inflation is a silent but powerful force that can significantly impact your retirement savings. It refers to the gradual increase in the price of goods and services over time, which erodes the purchasing power of your money. When creating your retirement budget, it's crucial to factor in inflation to ensure that your savings will last throughout your retirement years. To account for inflation, you can use a historical inflation rate or project a future inflation rate based on economic forecasts.

Many retirement planning tools and calculators automatically adjust for inflation, making it easier to estimate your future expenses. Keep in mind that inflation can vary across different expense categories. For example, healthcare costs tend to increase at a higher rate than other expenses. Consider adjusting your budget to account for these varying inflation rates. Regularly review and update your budget to reflect changes in inflation. As inflation rates fluctuate, you may need to adjust your spending or savings habits to maintain your financial security. Failing to account for inflation can lead to underestimating your future expenses and potentially running out of money during retirement. Therefore, it's essential to incorporate inflation into your retirement budget to ensure that your savings will sustain you throughout your golden years.

By understanding inflation's impact and incorporating it into your budget, you can create a more realistic and sustainable retirement plan. Don't underestimate the power of inflation; it can significantly impact your financial well-being during retirement.

Fun Facts About Retirement Planning

Did you know that the average retirement lasts about 18 years? That's a significant portion of your life, highlighting the importance of careful planning. Another fun fact: many retirees actually report spending more in the early years of retirement as they pursue travel and hobbies before potentially scaling back later on. It is also a common misconception that you'll automatically spend less in retirement. While some expenses may decrease (like commuting costs), others may increase (like healthcare and leisure activities).

Retirement planning is not a one-size-fits-all approach. What works for one person may not work for another, depending on their individual circumstances, goals, and risk tolerance. Studies have shown that retirees who have a written retirement plan are more likely to feel confident and secure about their financial future. Also, the biggest regret of many retirees is not starting to save early enough. The power of compounding interest is immense, so the earlier you start saving, the more your money can grow over time. Another interesting tidbit is that many people underestimate the psychological impact of retirement. Adjusting to a new routine and finding purpose outside of work can be challenging, so it's important to plan for both the financial and emotional aspects of retirement.

By being aware of these fun facts and common pitfalls, you can approach retirement planning with a more informed and proactive mindset. Retirement should be a time of enjoyment and fulfillment, and careful planning can help you achieve that goal.

How to Create Your Retirement Budget Worksheet

Creating your retirement budget worksheet doesn't have to be a daunting task. Start by gathering all your financial documents, including bank statements, investment statements, and expense records. Next, choose a worksheet template that suits your needs. There are many free templates available online, or you can create your own using a spreadsheet program like Excel or Google Sheets. Begin by estimating your income sources. This may include Social Security benefits, pension income, 401k withdrawals, and investment income. Use online calculators to estimate your Social Security benefits and consult with your pension provider for accurate information.

Next, estimate your expenses. Break down your expenses into categories such as housing, healthcare, food, transportation, and entertainment. Be as detailed as possible when estimating your expenses. Don't forget to factor in unexpected costs such as home repairs or medical emergencies. Once you have estimated your income and expenses, subtract your expenses from your income to determine your net cash flow. If your expenses exceed your income, you will need to make adjustments to your budget. Consider reducing your expenses, increasing your income, or delaying your retirement date.

Regularly review and update your budget. Retirement planning is an ongoing process, and your budget should be adjusted as your circumstances change. Consider seeking professional advice from a financial advisor. A financial advisor can provide personalized guidance and help you create a comprehensive retirement plan. By following these steps, you can create a retirement budget worksheet that will help you achieve your financial goals and enjoy a comfortable retirement.

What if Your Retirement Budget Falls Short?

Discovering that your retirement budget falls short can be unsettling, but it's not necessarily a cause for panic. The key is to address the issue proactively and explore your options. First, review your expenses and identify areas where you can potentially cut back. Even small reductions in spending can add up over time. Consider delaying your retirement date. Working even a few extra years can significantly boost your retirement savings and reduce the number of years you need to rely on your savings.

Explore alternative income sources. Consider part-time work, consulting, or starting a small business. These activities can provide additional income and keep you engaged and active during retirement. Adjust your investment strategy. Consider shifting your portfolio towards investments with higher potential returns, but be mindful of the increased risk. Downsize your home. Moving to a smaller home can significantly reduce your housing costs and free up capital for retirement. Consult with a financial advisor. A financial advisor can help you assess your situation, develop a plan to address the shortfall, and provide guidance on investment strategies and financial planning.

Don't be afraid to seek help. There are many resources available to assist you with retirement planning, including government agencies, non-profit organizations, and financial professionals. By taking proactive steps and exploring your options, you can overcome a retirement budget shortfall and achieve your financial goals. The most important thing is to address the issue early and avoid making hasty decisions.

Listicle: 5 Essential Items to Include in Your Retirement Budget Worksheet

1.Housing Costs: Accurately estimate your mortgage or rent payments, property taxes, insurance, and maintenance expenses. Don't forget to factor in potential increases in property taxes or insurance premiums.

2.Healthcare Expenses: Plan for premiums, deductibles, co-pays, and out-of-pocket costs. Research average healthcare costs in your area and consider purchasing supplemental insurance to cover potential gaps in coverage.

3.Food Expenses: Include both groceries and dining out. Track your current spending habits to get a realistic estimate of your food costs in retirement.

4.Transportation Costs: Factor in car payments, insurance, gas, and maintenance. Consider alternative transportation options, such as public transportation or walking, to reduce your transportation expenses.

5.Entertainment and Recreation: Budget for hobbies, travel, and social activities. These expenses are essential for maintaining a fulfilling and enjoyable retirement lifestyle. Don't underestimate the importance of these expenses in contributing to your overall well-being.

Question and Answer

Q: How often should I update my retirement budget worksheet?

A: At least once a year, or more frequently if you experience significant changes in your income, expenses, or life circumstances.

Q: What if I don't know how much I'll spend on certain expenses in retirement?

A: Estimate based on your current spending habits, research average costs in your desired retirement location, and add a contingency fund for unexpected expenses.

Q: Is it okay to use a free retirement budget worksheet, or should I pay for a professional tool?

A: Free worksheets can be a great starting point. As your planning becomes more complex, you might consider professional tools or consulting with a financial advisor.

Q: What if I'm already retired and haven't created a budget worksheet?

A: It's never too late to start! Creating a budget worksheet can help you track your spending, identify areas where you can save money, and ensure that your savings last throughout your retirement.

Conclusion of Free Retirement Budget Worksheet: Plan Your Retirement Expenses

In conclusion, a free retirement budget worksheet is an invaluable tool for anyone planning for their future. By taking the time to carefully estimate your income and expenses, you can gain a clearer picture of your financial needs in retirement and take steps to secure your financial well-being. Don't wait until retirement is just around the corner; start planning today and enjoy the peace of mind that comes with knowing you're prepared for the future.

Post a Comment