Large Family Retirement Planning: Balance Kids and Savings

Imagine trying to juggle a dozen balls at once, each representing a child’s need, a looming expense, or a future dream. Now, imagine trying to juggle those while simultaneously planning for a comfortable retirement. Sounds overwhelming, right? You’re not alone. Large families face unique challenges when it comes to securing their financial futures, but it's absolutely achievable with the right strategies.

Raising a large family is a beautiful, chaotic adventure filled with love and laughter. However, it also means navigating a constant stream of expenses: diapers, school fees, extracurricular activities, and eventually, college tuition for many. The sheer volume of immediate needs can make it feel impossible to prioritize long-term financial goals, like retirement savings. Sacrifices are often made, and the future can seem daunting. The financial load feels heavier, and the path toward retirement may seem obscured by the many demands of raising a large family.

This article provides guidance and practical tips tailored to the unique circumstances of large families. We'll explore strategies for balancing the immediate financial demands of raising many children with the crucial need to save for retirement. We aim to equip you with the knowledge and tools to navigate the complexities of family finances while building a secure and fulfilling retirement.

Ultimately, successfully managing retirement planning in a large family boils down to prioritizing, strategizing, and consistent effort. We'll delve into creating realistic budgets, exploring investment options, maximizing tax advantages, and finding creative ways to increase income. Consider this your guide to balancing family needs and retirement aspirations, setting you on a course towards a brighter financial future. Let's explore budgeting, savings, investments, and tax strategies for large families.

Start Early, Even Small

The target of starting early, even with small amounts, is to harness the power of compounding interest over a longer period. Time is your greatest asset when it comes to investing, and even small contributions, consistently made, can grow significantly over decades.

I remember when my wife and I had our third child, we felt completely overwhelmed. Retirement felt like a distant dream, and every spare dollar seemed to disappear instantly. We initially thought we couldn't possibly afford to contribute to retirement. But, a financial advisor challenged us to start small. He suggested we automate a small monthly transfer to a Roth IRA. We started with just $50 a month. It felt insignificant at the time, but the key was consistency. Over time, as our income grew, we increased our contributions. Now, years later, that initial investment, along with consistent contributions, has grown into a substantial nest egg. Starting early, even with small amounts, can alleviate the pressure of needing to save larger amounts later in life.

The principle of compound interest is crucial here. It's the snowball effect – your earnings generate their own earnings, and that growth accelerates over time. Even if your income is tight, finding ways to free up a small amount and investing it consistently will pay dividends in the long run. Focus on setting realistic savings goals, exploring tax-advantaged accounts like 401(k)s or IRAs, and automating your contributions so that saving becomes a habit, not an afterthought. Don't let the feeling of being overwhelmed prevent you from taking that first step. Remember, every dollar saved today is a dollar working for your future.

Creating a Realistic Budget

Creating a realistic budget helps you track your income and expenses, identify areas where you can save, and allocate funds towards retirement. It's about understanding where your money is going and making informed decisions about how to use it effectively.

A budget is more than just a list of income and expenses; it's a financial roadmap that guides your spending and savings decisions. For large families, creating a detailed budget is essential for managing the many expenses associated with raising children. Start by tracking your income and expenses for a month or two to understand your spending patterns. Identify areas where you can cut back, such as dining out, entertainment, or subscriptions. Prioritize essential expenses like housing, food, and healthcare, and then allocate the remaining funds towards savings and retirement.

Use budgeting tools or apps to help you track your spending and stay on track. Consider implementing strategies like meal planning, couponing, and buying in bulk to reduce your grocery bill. Look for affordable entertainment options, such as family game nights or outdoor activities. By creating a realistic budget and sticking to it, you can free up more money to save for retirement while still meeting your family's needs. A well-structured budget will provide insights into available funds and help you realize your goal of saving for retirement.

The Myth of "Having It All"

The myth of "having it all" suggests that you can simultaneously excel in your career, raise a large family, and achieve financial independence without making any sacrifices. This belief can lead to unrealistic expectations and feelings of guilt when you inevitably face challenges.

The societal pressure to "have it all" can be especially intense for parents of large families. You might feel obligated to provide your children with every opportunity while also building a successful career and saving for retirement. However, trying to do everything at once can lead to burnout and financial strain.

It's important to recognize that achieving financial security and raising a large family requires trade-offs. You may need to prioritize certain expenses over others or make sacrifices in your lifestyle. For example, you might choose to drive a less expensive car or take fewer vacations to save more money for retirement. It is also important to know that you are not alone.

Focus on setting realistic goals and prioritizing what truly matters to you and your family. Remember that financial success is not about having it all, but about making informed choices that align with your values and long-term goals. Redefine success as a journey of growth and fulfillment, rather than a pursuit of perfection. Embracing a realistic perspective can help you manage your finances with greater confidence and peace of mind.

Hidden Benefits of a Large Family

While raising a large family presents financial challenges, it also offers unique benefits that can contribute to your overall well-being and retirement planning. These benefits often go unnoticed, but they can significantly impact your long-term financial health.

One hidden benefit is the sense of community and support that naturally develops within a large family. Children often learn to share, cooperate, and support each other, reducing the burden on parents. As your children grow older, they can contribute to household chores, care for younger siblings, and even provide financial assistance. This mutual support system can alleviate stress and free up time and resources for other priorities.

Another benefit is the potential for shared expenses as your children become adults. Older children may be able to help with household bills, contribute to family vacations, or provide care for aging parents. This shared responsibility can significantly reduce your financial burden during retirement.

Large families also tend to be more resourceful and creative when it comes to saving money. Parents learn to make the most of limited resources, find affordable entertainment options, and teach their children the value of thriftiness. These habits can translate into long-term financial stability.

Embrace the hidden benefits of your large family and leverage them to your advantage. Foster a culture of collaboration, teach your children financial literacy, and build a strong support system. These factors can make a significant difference in your ability to achieve your retirement goals.

Recommendation from Financial Expert

Financial experts recommend prioritizing retirement savings early and consistently, even if it means making sacrifices in other areas. They emphasize the importance of creating a diversified investment portfolio and seeking professional financial advice to navigate the complexities of retirement planning.

Financial advisors often suggest maximizing contributions to tax-advantaged accounts like 401(k)s or IRAs to reduce your tax liability and accelerate your savings. They also recommend exploring alternative income streams, such as side hustles or rental properties, to supplement your retirement income.

When it comes to large families, experts advise creating a detailed financial plan that takes into account the unique expenses associated with raising children. This plan should include strategies for managing debt, saving for college, and protecting your assets.

It's also essential to have a realistic understanding of your retirement needs and to adjust your savings goals accordingly. Financial experts can help you estimate your future expenses and determine how much you need to save to achieve a comfortable retirement.

Seek guidance from a qualified financial advisor who specializes in working with large families. They can provide personalized advice and help you develop a comprehensive retirement plan that aligns with your goals and values. Remember, investing in your financial future is one of the best ways to provide for your family's well-being.

Investing in Education

Investing in your children's education is a significant expense for large families, but it's also an investment in their future and your own. By providing your children with a quality education, you are increasing their earning potential and reducing their reliance on you in the future.

There are several strategies you can use to make education more affordable. Consider enrolling your children in public schools or exploring alternative educational options like homeschooling or online learning. Look for scholarships, grants, and financial aid opportunities to help cover tuition costs.

Start saving for college early by opening a 529 plan or other tax-advantaged savings account. Encourage your children to work part-time jobs or participate in extracurricular activities that can help them develop valuable skills and earn money for college.

It's also important to teach your children financial literacy and to involve them in the family's financial planning process. This can help them develop a responsible attitude towards money and prepare them for future financial success.

By investing in your children's education, you are not only providing them with a brighter future but also reducing your long-term financial burden. A well-educated child is more likely to become financially independent and contribute to the family's overall financial well-being.

Tax-Advantaged Savings

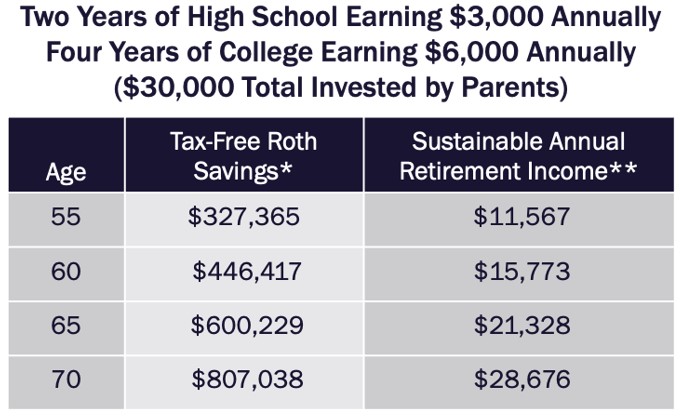

Tax-advantaged savings accounts, such as 401(k)s, IRAs, and 529 plans, can significantly reduce your tax liability and accelerate your retirement savings. These accounts offer various tax benefits, such as tax-deductible contributions, tax-deferred growth, and tax-free withdrawals.

Contributing to a 401(k) allows you to reduce your taxable income, potentially lowering your tax bill. The money in your 401(k) grows tax-deferred, meaning you don't pay taxes on the earnings until you withdraw them in retirement. Roth IRAs offer tax-free withdrawals in retirement, which can be a significant advantage if you expect your tax rate to be higher in the future.

529 plans are specifically designed for saving for college expenses. Contributions to a 529 plan are not tax-deductible at the federal level, but many states offer tax deductions or credits. The money in a 529 plan grows tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

Maximize your contributions to tax-advantaged accounts to reduce your tax burden and accelerate your retirement savings. Consult with a financial advisor to determine which accounts are best suited for your individual circumstances and goals.

Cutting Costs Without Sacrificing Quality

Finding ways to cut costs without sacrificing quality is essential for large families striving to balance their budget and save for retirement. This involves making smart choices about your spending habits and prioritizing value over extravagance.

One way to cut costs is to comparison shop for everything from groceries to insurance. Take the time to research different options and compare prices to ensure you're getting the best deal. Consider buying in bulk for items you use frequently, but be mindful of expiration dates to avoid waste.

Look for affordable entertainment options, such as free community events, parks, and libraries. Instead of dining out frequently, try cooking meals at home and packing lunches for work and school.

Consider downsizing your home or car to reduce your monthly expenses. Evaluate your insurance policies to ensure you're not overpaying for coverage you don't need. Look for discounts and promotions on products and services you use regularly.

By making conscious choices about your spending habits and prioritizing value, you can cut costs without sacrificing quality and free up more money for retirement savings.

Fun Facts About Large Families

Large families have been a part of human history for centuries, and they come with some interesting and often surprising facts. Did you know that families with four or more children often report higher levels of happiness and fulfillment?

Studies have shown that children from large families tend to be more resilient, adaptable, and socially adept. They learn to share, cooperate, and negotiate from an early age, which can benefit them throughout their lives.

Large families also tend to be more resourceful and creative when it comes to managing their finances. Parents learn to make the most of limited resources and to find innovative solutions to everyday challenges.

Despite the financial challenges, large families often have stronger family bonds and a greater sense of community. Children from large families tend to be more connected to their siblings and parents, creating a strong support system that can last a lifetime.

While raising a large family may not be easy, it can be an incredibly rewarding experience. The love, laughter, and memories you create with your children will be priceless.

How To Maximize Income Potential

Maximizing your income potential is crucial for large families seeking to balance their budget and save for retirement. This involves exploring various income streams and developing strategies to increase your earning power.

Consider pursuing additional education or training to enhance your skills and qualifications. This can open doors to higher-paying job opportunities and increase your earning potential. Look for opportunities to advance in your current career or to transition to a more lucrative field.

Explore alternative income streams, such as starting a side hustle or investing in rental properties. A side hustle can provide a supplemental income to help you pay off debt or save for retirement. Rental properties can generate passive income that can supplement your retirement savings.

Consider starting your own business. Owning a business can provide you with greater control over your income and allow you to build wealth over time. Develop a business plan, secure funding, and market your products or services effectively.

Network with other professionals in your field to learn about job opportunities and industry trends. Attend industry events, join professional organizations, and connect with people on social media.

By maximizing your income potential, you can improve your financial stability and accelerate your progress towards retirement.

What If You Fall Behind?

It's important to have a plan in place for what to do if you fall behind on your retirement savings goals. Life is unpredictable, and unexpected expenses or job loss can derail your progress.

First, don't panic. It's never too late to get back on track. Start by reassessing your budget and identifying areas where you can cut back on expenses. Look for ways to increase your income, such as taking on a part-time job or selling unwanted items.

Consider delaying your retirement date. Working a few extra years can significantly boost your retirement savings and reduce the amount of money you need to withdraw each year.

If you have credit card debt or other high-interest loans, prioritize paying them off as quickly as possible. High-interest debt can eat away at your savings and make it more difficult to reach your retirement goals.

Consult with a financial advisor to develop a revised retirement plan that takes into account your current circumstances. A financial advisor can help you identify strategies to catch up on your savings and ensure a comfortable retirement.

Remember, staying positive and proactive is key to overcoming setbacks and achieving your retirement goals.

Listicle of Essential Strategies

Here's a listicle of essential strategies for large family retirement planning:

- Start saving early, even if it's just a small amount.

- Create a realistic budget and stick to it.

- Maximize contributions to tax-advantaged accounts.

- Invest in a diversified portfolio.

- Explore alternative income streams.

- Reduce expenses without sacrificing quality.

- Teach your children financial literacy.

- Seek professional financial advice.

- Review and adjust your plan regularly.

- Stay positive and proactive.

By implementing these strategies, you can increase your chances of achieving a secure and fulfilling retirement, even with the financial demands of a large family.

Question and Answer

Here are some common questions and answers about large family retirement planning:Q: Is it possible to save for retirement with a large family?

A: Yes, it is possible. It requires careful planning, budgeting, and consistent effort, but it is definitely achievable.

Q: How much should I be saving for retirement?

A: The amount you should save depends on your individual circumstances and goals. A general guideline is to aim to save at least 15% of your income for retirement.

Q: What are the best investment options for retirement?

A: The best investment options depend on your risk tolerance and time horizon. A diversified portfolio that includes stocks, bonds, and mutual funds is generally recommended.

Q: Where can I get help with retirement planning?

A: You can consult with a financial advisor who specializes in working with large families. They can provide personalized advice and help you develop a comprehensive retirement plan.

Conclusion of Large Family Retirement Planning: Balance Kids and Savings

Balancing the joys and demands of raising a large family with the crucial need to save for retirement presents a unique set of challenges. However, with careful planning, disciplined budgeting, and a commitment to long-term financial security, it's absolutely possible to achieve both. By starting early, maximizing tax advantages, exploring creative income streams, and seeking professional guidance, you can navigate the complexities of family finances and build a brighter future for yourselves and your children. Remember, it's not about having it all, but about making smart choices that align with your values and goals. Embrace the journey, stay focused, and celebrate every milestone along the way.

Post a Comment