Retirement Income Planning: Create Reliable Monthly Cash Flow

Imagine waking up each morning, knowing that your bills are covered and you can spend your time doing the things you truly love. No more stressing about making ends meet or worrying about outliving your savings. Sounds like a dream, right? It's achievable with careful retirement income planning.

Many people approach retirement with a sense of unease. The thought of transitioning from a steady paycheck to relying on savings and investments can feel daunting. Figuring out how to transform a nest egg into a consistent stream of income, managing expenses, and navigating potential market fluctuations can leave you feeling uncertain about the future.

Retirement income planning is all about creating a strategy to ensure you have a reliable monthly cash flow throughout your retirement years. It involves carefully assessing your assets, estimating your expenses, and developing a plan to generate the income you need to live comfortably and pursue your passions. This proactive approach empowers you to take control of your financial future and enjoy the retirement you've always envisioned.

This article explores the essential elements of retirement income planning, including understanding your income needs, exploring various income sources, and developing a sustainable withdrawal strategy. By focusing on creating a dependable monthly cash flow, you can approach retirement with confidence and security.

Understanding Your Retirement Income Needs

Understanding your retirement income needs is the cornerstone of successful retirement planning. It's not simply about having a large sum of money saved; it's about knowing how much you'll need each month to cover your expenses and maintain your desired lifestyle.

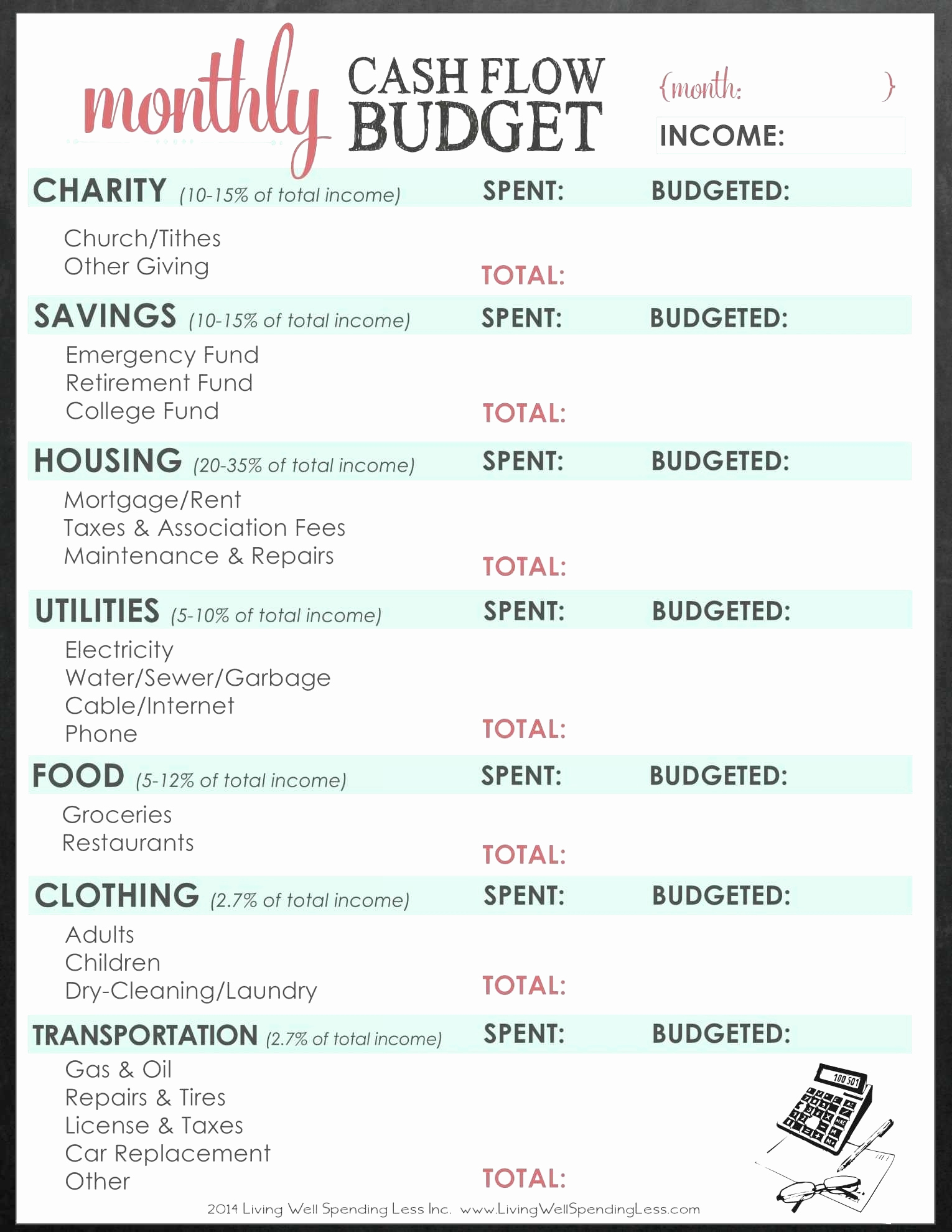

I remember helping my parents navigate this process a few years ago. Initially, they were overwhelmed by the sheer number of variables involved. They had a vague idea of their savings but hadn't fully considered all their expenses, especially potential healthcare costs and travel plans. We sat down and meticulously went through their current spending habits, identifying essential expenses like housing, utilities, and food, as well as discretionary spending on hobbies, entertainment, and travel. We factored in inflation and estimated future healthcare costs, which, as they got older, were likely to increase. It was eye-opening for them to see a clear picture of their anticipated monthly expenses. This exercise gave them a much better understanding of the income they would need to generate from their savings and investments.

Accurately estimating your retirement income needs involves more than just projecting current expenses. You need to consider factors like inflation, healthcare costs, and potential long-term care needs. Also, remember to consider how your spending habits might change. You may spend more on travel and leisure initially, but your expenses might decrease as you age. Creating a detailed budget and regularly reviewing it is crucial for staying on track. Understanding your income needs is not a one-time task, but an ongoing process that adapts to your changing circumstances and goals. By taking the time to assess your needs accurately, you can build a retirement plan that provides you with the financial security and peace of mind you deserve.

Exploring Retirement Income Sources

Many different sources of income can be combined to provide sufficient cash flow during retirement. Social Security is often the foundation for a large proportion of Americans, and is dependent on prior earnings and the age at which benefits are claimed. Employer-sponsored retirement plans, such as 401(k)s and pensions, can provide a substantial income stream, especially for those who have consistently contributed over many years. Personal savings and investments, including IRAs, brokerage accounts, and real estate, offer flexibility and potential for growth. Part-time work, consulting, or pursuing a passion project can supplement retirement income and provide a sense of purpose and engagement.

It's important to strategically manage each income source to maximize its benefits. For example, delaying Social Security benefits can significantly increase the monthly payment. Diversifying investments can reduce risk and improve long-term returns. Converting traditional retirement accounts to Roth accounts can provide tax-free income in retirement. By carefully considering all available income sources and managing them effectively, you can create a well-rounded and sustainable retirement income plan. Some retirees choose to purchase annuities, which provide guaranteed income for life, but it's important to weigh the pros and cons before making such a decision.

History and Myths of Retirement Income Planning

Retirement income planning has evolved significantly over the years. In the past, many retirees relied primarily on pensions and Social Security. These sources provided a relatively stable income stream, but they were not always sufficient to meet individual needs or account for inflation. Today, with the decline of traditional pensions and the increasing responsibility placed on individuals to manage their own retirement savings, the need for comprehensive retirement income planning has become more critical than ever.

Several myths surround retirement income planning that can lead to poor decisions. One common myth is that you can simply withdraw a fixed percentage of your savings each year without depleting your assets. Another myth is that you can accurately predict your investment returns and healthcare costs. Still another states, once you retire, you never need to work another day. Such simplifications ignore market volatility, inflation, and unexpected expenses. It's important to challenge these myths and approach retirement income planning with a realistic and adaptable mindset. Consulting with a qualified financial advisor can help you develop a personalized plan that addresses your specific circumstances and mitigates potential risks.

Hidden Secrets of Retirement Income Planning

One of the hidden secrets of retirement income planning is the power of tax optimization. Many retirees overlook opportunities to minimize their tax liability, which can significantly increase their after-tax income. Strategies such as Roth conversions, tax-loss harvesting, and charitable giving can help reduce taxes and maximize your savings.

Another hidden secret is the importance of long-term care planning. The cost of long-term care can be substantial, and it can quickly deplete your retirement savings. Planning for potential long-term care needs, whether through insurance or other means, is crucial for protecting your financial security. A third hidden secret is the value of seeking professional advice. A qualified financial advisor can provide personalized guidance, help you navigate complex financial decisions, and ensure that your retirement plan is aligned with your goals and values. Retirement planning is not just about accumulating wealth, but about managing it effectively to achieve a secure and fulfilling retirement.

Recommendations for Retirement Income Planning

Start planning early. The earlier you start planning for retirement, the more time you have to save and invest, and the more flexibility you have to adjust your strategy as needed. Assess your current financial situation. Take stock of your assets, debts, and expenses to get a clear picture of where you stand. Set realistic retirement goals. Determine how much income you'll need to cover your expenses and maintain your desired lifestyle.

Develop a diversified investment strategy. Don't put all your eggs in one basket. Diversify your investments across different asset classes to reduce risk and improve long-term returns. Create a withdrawal strategy. Determine how you'll withdraw funds from your retirement accounts to ensure that you don't outlive your savings. Rebalance your portfolio regularly. Rebalance your portfolio to maintain your desired asset allocation and manage risk. Review your plan regularly. Review your retirement plan at least once a year to ensure that it's still aligned with your goals and circumstances. Seek professional advice. Consult with a qualified financial advisor to get personalized guidance and support.

Understanding Withdrawal Strategies

A sustainable withdrawal strategy is essential for ensuring that your retirement savings last throughout your retirement years. The traditional rule of thumb is the "4% rule," which suggests that you can withdraw 4% of your savings each year without depleting your assets. However, this rule may not be appropriate for everyone, as it doesn't account for factors like inflation, market volatility, and individual spending habits.

A more sophisticated approach is to use a dynamic withdrawal strategy, which adjusts your withdrawals based on market performance and inflation. This strategy can help you avoid depleting your savings during market downturns and allow you to increase your withdrawals during periods of strong growth. Another approach is to create a "bucket strategy," which divides your savings into different buckets based on time horizon and risk tolerance. This strategy can help you manage risk and ensure that you have access to the funds you need when you need them. No matter which strategy you choose, it's important to regularly monitor your withdrawals and adjust your plan as needed.

Tips for Retirement Income Planning

Consider delaying Social Security benefits. Delaying Social Security benefits can significantly increase your monthly payment, providing a larger and more secure income stream in retirement. Reduce your expenses. The less you spend, the less income you'll need to generate from your savings. Pay off debt. Reducing your debt can free up cash flow and reduce stress in retirement.

Stay healthy. Maintaining your health can reduce healthcare costs and improve your quality of life in retirement. Pursue your passions. Engaging in activities you enjoy can provide a sense of purpose and fulfillment in retirement. Stay connected. Maintaining social connections can improve your mental and emotional well-being in retirement. Be flexible. Be prepared to adjust your retirement plan as needed to account for unexpected expenses or changes in your circumstances.

The Importance of Asset Allocation

Asset allocation is the process of dividing your investments among different asset classes, such as stocks, bonds, and real estate. A well-diversified asset allocation strategy can help you manage risk and improve long-term returns. The optimal asset allocation depends on your individual circumstances, including your risk tolerance, time horizon, and financial goals.

Generally, younger investors with a longer time horizon can afford to take on more risk and invest a larger portion of their portfolio in stocks. Older investors with a shorter time horizon may prefer a more conservative asset allocation with a larger portion of their portfolio in bonds. It's important to rebalance your portfolio regularly to maintain your desired asset allocation and manage risk. Rebalancing involves selling some of your investments that have performed well and buying more of those that have underperformed. This can help you maintain your desired risk level and potentially improve your long-term returns.

Fun Facts of Retirement Income Planning

Did you know that the average retirement lasts for 18 years? That's a lot of time to fill with activities you enjoy. Social Security was signed into law in 1935 as part of President Franklin D. Roosevelt's New Deal. The 401(k) plan was created in 1978 as a way for companies to offer employees a tax-advantaged way to save for retirement.

The first retirement community was Sun City, Arizona, which opened in 1960. Studies have shown that retirees who have a plan for their retirement are happier and more fulfilled than those who don't. Retirement is not just about money. It's also about your health, your relationships, and your sense of purpose. Planning for all aspects of your retirement can help you make the most of this exciting chapter in your life. Thinking about these details and planning ahead can really transform the retirement years into the most fulfilling and amazing experience possible.

How to Create a Retirement Income Plan

Creating a retirement income plan involves several key steps. First, assess your current financial situation, including your assets, debts, and expenses. Second, estimate your retirement income needs, considering factors like inflation, healthcare costs, and potential long-term care needs. Third, explore various income sources, including Social Security, retirement accounts, and other investments.

Fourth, develop a withdrawal strategy that will allow you to generate the income you need without depleting your savings too quickly. Fifth, create a budget that outlines your income and expenses. Sixth, rebalance your portfolio regularly to maintain your desired asset allocation. Seventh, review your plan at least once a year to ensure that it's still aligned with your goals and circumstances. Eighth, seek professional advice from a qualified financial advisor to get personalized guidance and support.

What If... in Retirement Income Planning

What if you live longer than expected? Longevity risk is a major concern for many retirees. If you live longer than expected, you'll need to have enough savings to cover your expenses for a longer period of time. What if you experience a market downturn? Market volatility can significantly impact your retirement savings. During a market downturn, your investments may lose value, and you may need to adjust your withdrawal strategy to avoid depleting your assets.

What if you experience unexpected expenses? Unexpected expenses, such as healthcare costs or home repairs, can derail your retirement plan. It's important to have a contingency fund to cover these expenses. What if you want to leave a legacy? Many retirees want to leave a legacy for their loved ones or support their favorite charities. Planning for your legacy can help you achieve this goal. What if you develop long-term care needs? The cost of long-term care can be substantial, and it can quickly deplete your retirement savings. Planning for potential long-term care needs is crucial for protecting your financial security.

Listicle of Retirement Income Planning: Create Reliable Monthly Cash Flow

1. Start Planning Early: The sooner, the better!

- Know Your Numbers: Understand your expenses and savings.

- Explore All Income Sources: Social Security, investments, part-time work.

- Create a Withdrawal Strategy: Don't outlive your savings.

- Diversify Your Investments: Manage risk and improve returns.

- Reduce Your Expenses: The less you spend, the more you save.

- Pay Off Debt: Free up cash flow and reduce stress.

- Stay Healthy: Lower healthcare costs and enjoy life.

- Review Your Plan Regularly: Adapt to changing circumstances.

- Seek Professional Advice: Get personalized guidance.

Question and Answer Section About Retirement Income Planning

Q: How much should I save for retirement?

A: The amount you need to save for retirement depends on your individual circumstances, including your expenses, income, and lifestyle. A general rule of thumb is to save 10-15% of your income each year, starting as early as possible.

Q: What are the best investments for retirement?

A: The best investments for retirement depend on your risk tolerance, time horizon, and financial goals. A diversified portfolio of stocks, bonds, and real estate is generally a good starting point.

Q: How can I create a sustainable withdrawal strategy?

A: A sustainable withdrawal strategy involves carefully considering your income needs, investment returns, and inflation. A general rule of thumb is to withdraw 4% of your savings each year, but you may need to adjust this based on your individual circumstances.

Q: How often should I review my retirement plan?

A: You should review your retirement plan at least once a year, or more often if your circumstances change. This will help you ensure that your plan is still aligned with your goals and that you're on track to achieve your retirement goals.

Conclusion of Retirement Income Planning: Create Reliable Monthly Cash Flow

Retirement income planning is a crucial step in ensuring a secure and fulfilling retirement. By understanding your income needs, exploring various income sources, and developing a sustainable withdrawal strategy, you can create a plan that provides you with a reliable monthly cash flow throughout your retirement years. Remember to start planning early, assess your current financial situation, set realistic goals, and seek professional advice. With careful planning and consistent effort, you can approach retirement with confidence and enjoy the financial freedom you deserve. Your future self will thank you for taking the time to plan and prepare for this exciting chapter in your life.

Post a Comment