Scrum Master Retirement: Agile Professional Planning

Imagine a future where your hard-earned agile expertise fuels not just your present career, but also a comfortable and fulfilling retirement. It's a future within reach, and it starts with careful planning.

Many agile professionals, particularly Scrum Masters, pour their heart and soul into guiding teams and fostering organizational agility. They dedicate years to mastering frameworks, coaching individuals, and driving continuous improvement. However, the long-term financial security that retirement provides often takes a backseat to the immediate demands of the profession.

The aim of this article is to guide Scrum Masters through the essential steps of planning for retirement, ensuring they can enjoy the fruits of their labor without compromising their financial well-being. We'll cover key aspects of financial planning, investment strategies tailored for agile professionals, and actionable steps you can take today to secure your future.

In this article, we've explored the importance of Scrum Master retirement planning. We highlighted the need for financial literacy, diversification of investments, and continuous adaptation of your retirement strategy. Key takeaways include understanding your risk tolerance, setting realistic financial goals, and seeking professional advice when needed. This is a journey that involves agile principles applied to your finances, ensuring flexibility and responsiveness to changing market conditions. Keywords covered include: Scrum Master, retirement planning, agile, financial planning, investment, diversification, financial literacy, risk tolerance, and financial goals.

Understanding Your Current Financial Landscape

The first step toward a secure retirement is a clear understanding of your current financial standing. I remember when I first started working, retirement seemed like a distant dream. I was so focused on paying bills and enjoying my life that saving for the future was rarely top of mind. It wasn't until I started attending financial planning workshops that I realized the importance of assessing my assets, liabilities, and cash flow. These workshops gave me the knowledge of what I needed to plan for my retirement and make informed decisions.

Begin by compiling a detailed list of all your assets, including savings accounts, investments, real estate, and any other valuable possessions. Next, assess your liabilities, such as mortgages, loans, and credit card debt. Finally, analyze your monthly income and expenses to determine your current cash flow. This comprehensive overview will provide a baseline for setting realistic financial goals and developing a tailored retirement plan. Evaluate your employer-sponsored retirement plans, like 401(k)s or pensions, and understand the contribution limits and matching policies. Maximize these benefits whenever possible, as they often provide a significant boost to your retirement savings. Consider opening individual retirement accounts (IRAs) to supplement your employer-sponsored plans. Roth IRAs, in particular, can be a valuable tool for tax-advantaged retirement savings. Regularly review your financial situation and make adjustments to your retirement plan as needed. Life events, such as marriage, children, or job changes, can significantly impact your financial goals and require modifications to your strategy.

Setting Realistic Retirement Goals

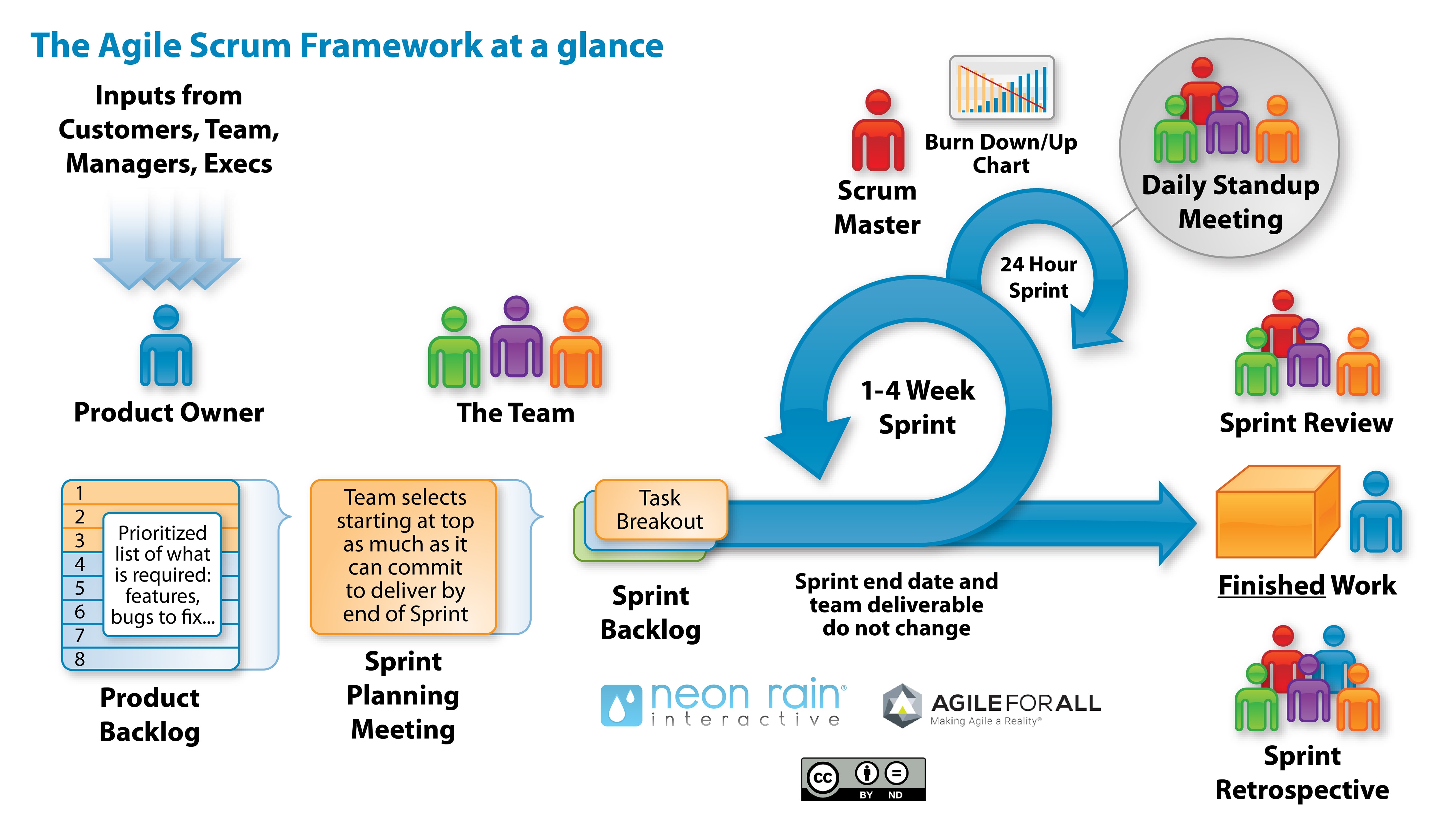

Retirement planning is like any agile project: it requires clearly defined goals to succeed. Scrum Masters excel at breaking down complex projects into manageable sprints, and the same approach can be applied to your retirement planning. It's not just about accumulating a certain amount of money; it's about defining the lifestyle you want to lead during your retirement years.

To start, envision your ideal retirement. Do you plan to travel the world, pursue hobbies, spend time with family, or start a new business? Once you have a clear picture of your desired lifestyle, you can estimate the expenses associated with it. Factor in essential living costs, healthcare expenses, travel budgets, and any other anticipated spending. Next, determine your desired retirement age. This will influence the amount of time you have to accumulate savings and the duration for which your retirement funds will need to last. Consider consulting with a financial advisor to get a more accurate estimate of your retirement needs. They can help you assess your current financial situation, project future expenses, and develop a personalized retirement plan. Financial goals are the foundation of Scrum Master Retirement: Agile Professional Planning, helping to navigate the complexities of financial investments and align with your future aspirations. These goals provide a clear roadmap, enabling informed decisions and proactive adjustments in retirement strategies.

The History and Myths of Retirement Planning

The concept of retirement as we know it is relatively modern. In the past, most people worked until they were physically unable to do so. The history of retirement planning is intertwined with social security and pension systems. Let's dispel some common myths.

One myth is that Social Security will be sufficient to cover all your retirement expenses. While Social Security can provide a safety net, it's typically not enough to maintain your pre-retirement lifestyle. Another myth is that you need to be wealthy to retire comfortably. With careful planning and disciplined saving, even those with modest incomes can achieve a secure retirement. A third myth is that retirement planning is only for older adults. The earlier you start saving, the more time your investments have to grow. Time is your greatest asset in retirement planning. The history of Scrum Master Retirement: Agile Professional Planning involves learning from past financial strategies, adapting to economic changes, and debunking common myths. Understanding the origins of retirement planning and the evolution of financial instruments can offer valuable insights for making informed decisions today.

Hidden Secrets of Successful Retirement

What are the secrets that successful retirees know? It's not just about accumulating wealth; it's about strategic planning and proactive management. One often-overlooked aspect is tax planning. Minimize your tax burden during retirement by strategically managing your retirement accounts and investments. Consider Roth conversions to reduce future tax liabilities and diversify your tax exposure.

Another secret is maintaining a healthy lifestyle. Healthcare expenses can significantly impact your retirement savings. Prioritize your physical and mental well-being to reduce your healthcare costs and improve your overall quality of life. Continuous learning and staying engaged in meaningful activities can also contribute to a fulfilling retirement. Explore new hobbies, volunteer your time, or pursue educational opportunities to keep your mind active and your social connections strong. Proactive risk management is crucial for Scrum Master Retirement: Agile Professional Planning, requiring you to anticipate potential financial setbacks and develop strategies to mitigate them. This involves continuous learning, staying updated on market trends, and seeking advice from financial experts to adapt your plans as needed.

Recommended Investment Strategies for Agile Professionals

As a Scrum Master, you're likely comfortable with iterative development and continuous improvement. The same principles apply to your investment strategy. There's no one-size-fits-all approach, but some strategies are particularly well-suited for agile professionals. Consider diversifying your investment portfolio across different asset classes, such as stocks, bonds, and real estate. This can help mitigate risk and improve your overall returns. Allocate a portion of your portfolio to growth stocks to capitalize on long-term growth opportunities. Balance this with more conservative investments, such as bonds, to provide stability and income.

Explore alternative investments, such as real estate or private equity, to further diversify your portfolio. However, be sure to conduct thorough due diligence and understand the risks involved. Consider investing in socially responsible investments (SRIs) that align with your values and contribute to a more sustainable future. Regularly review your investment portfolio and make adjustments as needed. Life events, market conditions, and changes in your risk tolerance can all warrant modifications to your strategy. Recommended Investment Strategies for Scrum Master Retirement: Agile Professional Planning focus on diversification, aligning with personal values, and continuous adaptation. These strategies aim to optimize returns while managing risk, ensuring a secure and fulfilling retirement.

Understanding the Power of Compounding

Compounding is the process of earning returns on your initial investment as well as the accumulated interest or gains. It's like a snowball effect – the longer you invest, the faster your money grows. The sooner you start investing, the more time your money has to compound. Even small contributions can add up significantly over time.

To maximize the power of compounding, reinvest your earnings rather than spending them. This allows your money to grow exponentially over the long term. Consider automating your investment contributions to ensure consistency and discipline. Set up automatic transfers from your checking account to your investment accounts to take advantage of dollar-cost averaging. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This can help reduce your risk and improve your long-term returns. Compounding is the cornerstone of Scrum Master Retirement: Agile Professional Planning, transforming small, consistent investments into substantial wealth over time. It underscores the importance of early planning and disciplined saving to leverage long-term growth potential.

Tips for Maximizing Your Retirement Savings

Maximizing your retirement savings is a continuous effort that requires discipline and strategic planning. A key tip is to increase your savings rate incrementally over time. Even small increases can make a significant difference in the long run. When you receive a raise or bonus, consider allocating a portion of it to your retirement savings.

Another tip is to take advantage of employer-sponsored retirement plans. Maximize your contributions to your 401(k) or other retirement plans, especially if your employer offers matching contributions. Matching contributions are essentially free money that can significantly boost your retirement savings. Also, consider consolidating your retirement accounts to simplify your financial management and reduce fees. Consolidating accounts can also make it easier to track your progress and stay on track toward your retirement goals. Tips for Maximizing Savings in Scrum Master Retirement: Agile Professional Planning involve incremental savings, leveraging employer contributions, and consolidating accounts. These proactive steps ensure efficient financial management and accelerated growth toward achieving retirement goals.

The Importance of Financial Literacy

Financial literacy is the foundation of successful retirement planning. It's about understanding basic financial concepts, such as budgeting, saving, investing, and debt management. Without a solid understanding of these concepts, it can be difficult to make informed financial decisions.

Improving your financial literacy can empower you to take control of your finances and plan for a secure retirement. There are many resources available to help you improve your financial literacy, including books, articles, online courses, and workshops. Consider seeking guidance from a financial advisor to gain personalized advice and develop a tailored retirement plan. A financial advisor can help you assess your current financial situation, set realistic goals, and develop a strategy to achieve those goals. Prioritizing financial literacy in Scrum Master Retirement: Agile Professional Planning empowers professionals to make informed decisions, manage their assets effectively, and secure their financial future. Enhanced understanding leads to better retirement outcomes.

Fun Facts About Retirement Planning

Did you know that the average retirement lasts longer today than it did a century ago? Advances in healthcare and lifestyle have increased life expectancy, meaning you'll need more savings to support a longer retirement. Another fun fact is that many retirees report being happier and more fulfilled than they were during their working years.

Retirement can be a time for pursuing passions, spending time with loved ones, and giving back to the community. Furthermore, planning for retirement is an example of agile project management, which involves iteratively planning and adjusting based on changing circumstances. Agile principles can be applied to manage investments and align with your retirement goals. Fun Facts about Scrum Master Retirement: Agile Professional Planning highlight the evolving nature of retirement, emphasizing the need for increased savings and prolonged planning. These facts emphasize the importance of adaptability and strategic adjustments to ensure a fulfilling and financially stable retirement.

How to Create a Retirement Plan as a Scrum Master

Creating a retirement plan as a Scrum Master can be approached in a similar way to managing an agile project. Start with a vision, set achievable goals, and iterate through the process. Begin by defining your retirement goals. What kind of lifestyle do you envision? How much income will you need to support that lifestyle?

Next, assess your current financial situation. What are your assets, liabilities, and cash flow? This will provide a baseline for your retirement plan. Develop a savings and investment strategy that aligns with your risk tolerance and retirement goals. Consider diversifying your investments across different asset classes to mitigate risk. Regularly review and adjust your retirement plan as needed. Life events, market conditions, and changes in your goals may require adjustments to your strategy. The core of Scrum Master Retirement: Agile Professional Planning is creating and adapting a detailed plan that reflects your personal circumstances and goals. Regular reviews, adjustments, and proactive management ensure the plan remains effective and aligned with your aspirations.

What if You Haven't Started Planning for Retirement?

It's never too late to start planning for retirement, even if you haven't saved much yet. The key is to take action now and develop a plan to catch up. Start by assessing your current financial situation and setting realistic goals. Determine how much you need to save each month to reach your retirement goals.

Next, create a budget and identify areas where you can cut expenses and increase your savings. Even small changes can make a big difference over time. Consider working with a financial advisor to develop a catch-up plan that addresses your specific needs and circumstances. A financial advisor can help you create a personalized strategy to maximize your savings and investments. If you haven't started, Scrum Master Retirement: Agile Professional Planning requires a proactive and adaptive approach. Financial advisors can help create a strategy for maximizing savings and investments.

Listicle: 10 Steps to Secure Your Scrum Master Retirement

Here's a list of 10 essential steps to secure your Scrum Master retirement:

- Assess your current financial situation. Understand your assets, liabilities, and cash flow.

- Set realistic retirement goals. Define the lifestyle you want to lead during retirement.

- Develop a savings and investment strategy. Diversify your investments and manage your risk.

- Take advantage of employer-sponsored retirement plans. Maximize your contributions to your 401(k) or other plans.

- Consider opening individual retirement accounts (IRAs). Supplement your employer-sponsored plans with IRAs.

- Manage your debt wisely. Reduce high-interest debt and avoid unnecessary borrowing.

- Create a budget and track your expenses. Monitor your spending and identify areas where you can save.

- Seek guidance from a financial advisor. Get personalized advice and develop a tailored retirement plan.

- Regularly review and adjust your retirement plan. Adapt your strategy to changing circumstances.

- Stay informed about financial trends and regulations. Keep up-to-date on the latest developments in retirement planning.

Following these steps makes the long journey towards Scrum Master Retirement: Agile Professional Planning a manageable listicle. It enables you to approach retirement with clarity, confidence, and a well-structured plan.

Question and Answer

Q: When should I start planning for retirement?

A: The sooner, the better. Starting early allows your investments to grow over a longer period, taking advantage of the power of compounding.

Q: How much should I save for retirement?

A: The amount you need to save depends on your desired lifestyle and retirement age. A general guideline is to aim for 10-15 times your annual salary by retirement.

Q: What are the best investments for retirement?

A: The best investments depend on your risk tolerance and time horizon. A diversified portfolio that includes stocks, bonds, and real estate is generally recommended.

Q: How can a financial advisor help me?

A: A financial advisor can help you assess your current financial situation, set realistic goals, and develop a tailored retirement plan. They can also provide ongoing guidance and support.

Conclusion of Scrum Master Retirement: Agile Professional Planning

Planning for retirement as a Scrum Master requires a proactive, adaptable, and continuous improvement mindset. By understanding your current financial landscape, setting realistic goals, and developing a tailored investment strategy, you can secure a comfortable and fulfilling retirement. Embrace financial literacy, diversify your investments, and regularly review your plan to ensure it aligns with your changing needs and circumstances. Remember, it's never too late to start planning, and the sooner you take action, the brighter your financial future will be.

Post a Comment